08 November 2024

Brent oil prices may decline in short-term under global changes

Brent crude oil prices are down on Friday, but keep aiming for a weekly gain as the market weighs the implications of the second presidency of Donald Trump. The focus is now on the prospects of increased stimulus in China, the largest oil importer, as well as the likelihood of prolonged trade tensions between the US and China. Trump’s policies could have a bearish impact on oil prices due to rising domestic production and potential tariffs. There is also a probability that the new president will limit Iranian oil exports.

On Friday, China’s top legislature will present the biggest fiscal package since the pandemic. That raises expectations of additional stimulus next year. As Standard Chartered Plc. notes, not all US oil producers may follow Trump’s call to increase output.

Markets are looking for some clarity on a probable increase in US oil supplies and potential tariffs on China.

Oil has been on a downward trend since early this year due to weak demand from China and higher supplies from producers outside the OPEC+ alliance.

The US Federal Reserve (Fed) cut interest rates by 0.25% on Thursday, as expected. Further, the Fed may slow down the pace of monetary easing because of inflation that could intensify amid Trump’s economic policies, including tax breaks and trade tariffs.

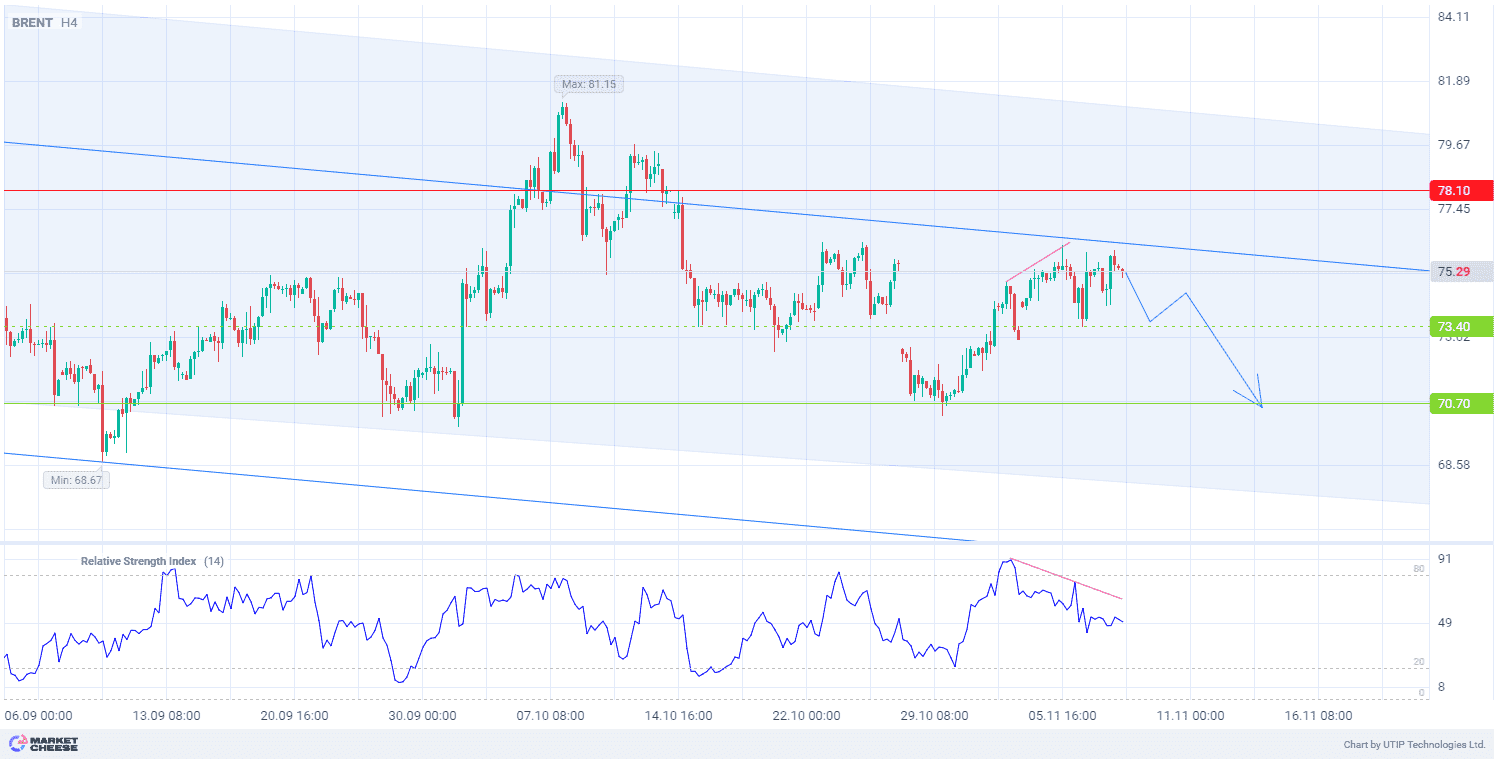

According to a technical analysis, Brent oil prices are forming a wide downtrend on the daily timeframe (D1). The prices are periodically testing the local trend lines of the channel. Currently, they are approaching resistance within the corridor. This indicates the possibility of a downward reversal from this level. The RSI divergence (standard values) has already suggested a decline in the price towards the trend channel support on the H4 timeframe.

Short-term prospects for Brent oil prices suggest selling with the target at 70.70. Part of the profit should be taken near the level of 73.40. A Stop loss could be set at 78.10.

Since the bearish trend is short-term, the trading volume should not exceed 2% of your total balance to reduce risks.

Зарабатывайте с Grande Club

Торгуйте на различных финансовых инструментах и получайте выгоду за счет разницы в цене

Обеспечьте себе высокий доход при движении курсов валют

Начать инвестировать