24 February 2025

Silver price is under mounting pressure due to elevated inflation rates and US Federal Reserve policy

Silver prices are trading above $32.50 during the Asian morning session on Monday. Prices are supported by weakening U.S. dollar, as well as demand for safe-haven assets amid geopolitical tensions and the tariff policy of U.S. President Donald Trump’s administration.

However, essential indicators suggest that silver’s worth may be on the verge of decreasing. As the Federal Reserve (Fed) has made clear, the regulator is not yet ready to cut interest rates quickly, waiting for more progress in bringing inflation down to its 2% target.

Inflation data remains the focus of traders’ attention. The Consumer Price Index (CPI) for January showed a stronger-than-expected gain. The monthly gain was 0.5%, while the annualized figure climbed to 3%. This is the highest value since June. According to investors’ expectations, the Fed’s key indicator, the Personal Consumption Expenditures Price Index, will show a more moderate increase this week.

Additionally, the risks of a global trade confrontation triggered by the introduction of new US duties on imports of automobiles, semiconductors, pharmaceuticals and lumber may lead to a slowdown in the economy. This will negatively affect industrial demand for the white metal, reducing its value.

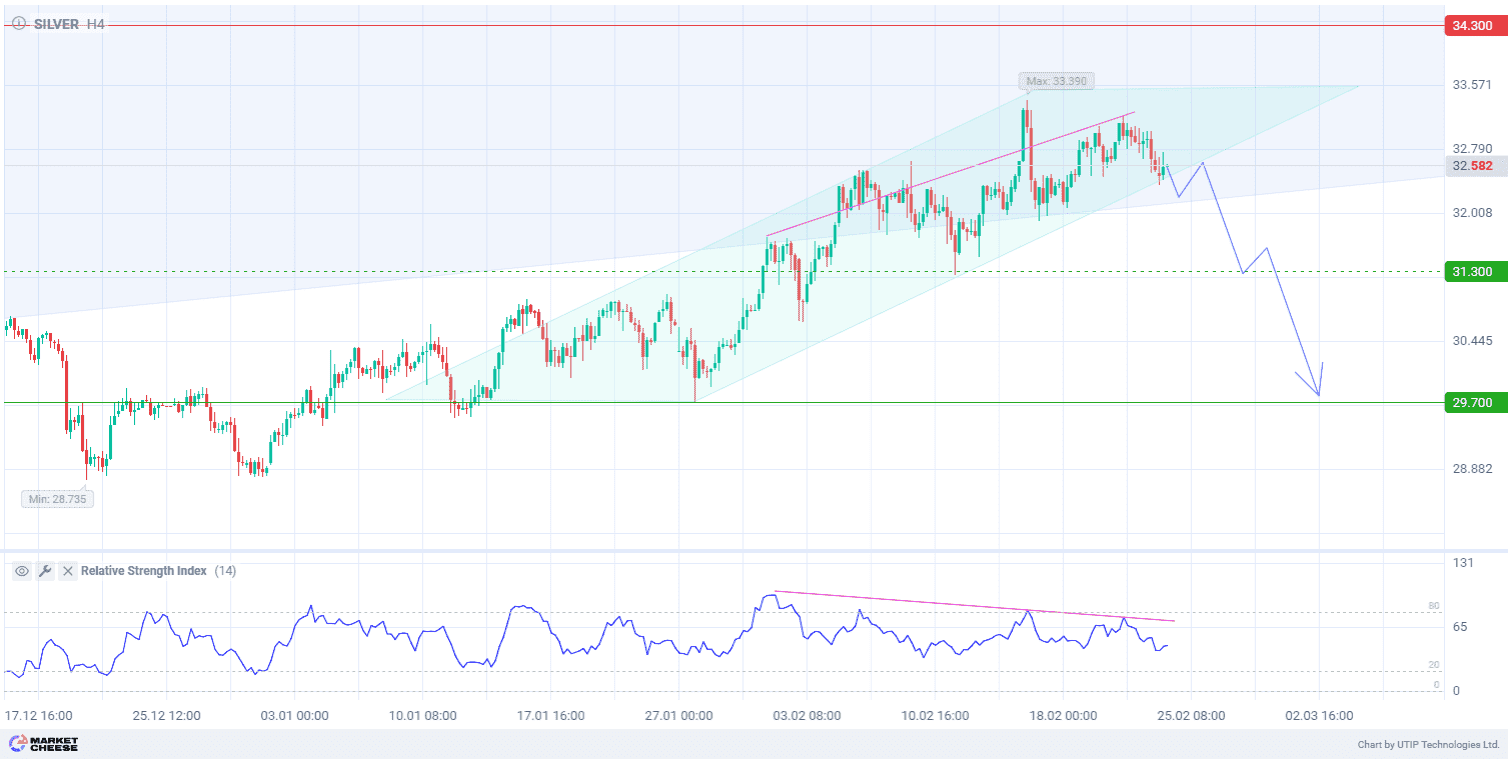

From a technical point of view, silver quotes are showing corrective growth along the previously broken support line of the ascending channel on the daily chart (D1). However, there is an uptrend on the four-hour (H4) timeframe, in which the price approached the support line. The Relative Strength indicator (standard parameters) signals the possibility of a decline and price exit from the corridor on the background of continuing divergence.

Signal:

The short-term outlook for silver suggests selling.

The target is at the level of 29,700.

Part of the profit should be fixed near the level of 31,300.

The loss limiter is located near the level of 34,300.

Since the bearish trend is short-term, the trading volume should not exceed 2% of your total balance to reduce risks.

Зарабатывайте с Grande Club

Торгуйте на различных финансовых инструментах и получайте выгоду за счет разницы в цене

Обеспечьте себе высокий доход при движении курсов валют

Начать инвестировать