19 February 2025

Selling EURUSD after short-term recovery

The currency pair EURUSD fell early this week. The prices declined from Friday’s closing level of 1.04914 to Tuesday’s level of 1.04446. On Wednesday, the opening price was 1.04426.

Despite fluctuating near two-month lows, the US dollar shows relative stability due to concerns about Trump’s trade policy and anticipation of the Fed’s action. The US Dollar Index at the level of 106.89 keeps upside potential, especially amid the rise of US consumer prices, which was the largest in a year and a half. It reinforces the probability of the Fed maintaining a cautious approach to rate cuts, although monetary easing is still possible in the second half of 2025.

The European market is under pressure due to the US trade restriction threats. The President of the Bundesbank Joachim Nagel warned that 10% tariffs on European goods could seriously hit the German economy, which is one of the largest in the region. This poses additional risks for the eurozone, especially for its manufacturing sector, which is already suffering from weak demand and high energy costs.

The European Commissioner for Economy Valdis Dombrovskis highlighted that the current US tariff policy has not yet had a notable impact on the EU economic recovery. However, the projected GDP growth of 1% seems rather modest. Meanwhile, the uncertainty around the US trade policy strengthens negative expectations of investors, who prefer to refrain from active purchases of euro.

European Manufacturing PMI is to be released on Friday, February 21. The index is currently 46.6 and is projected to rise to 46.9. The increased forecast may temporarily support the euro, but its significant strengthening is not expected due to the indicator remaining in recession. The index below 46.9 would increase negative expectations, putting pressure on EUR.

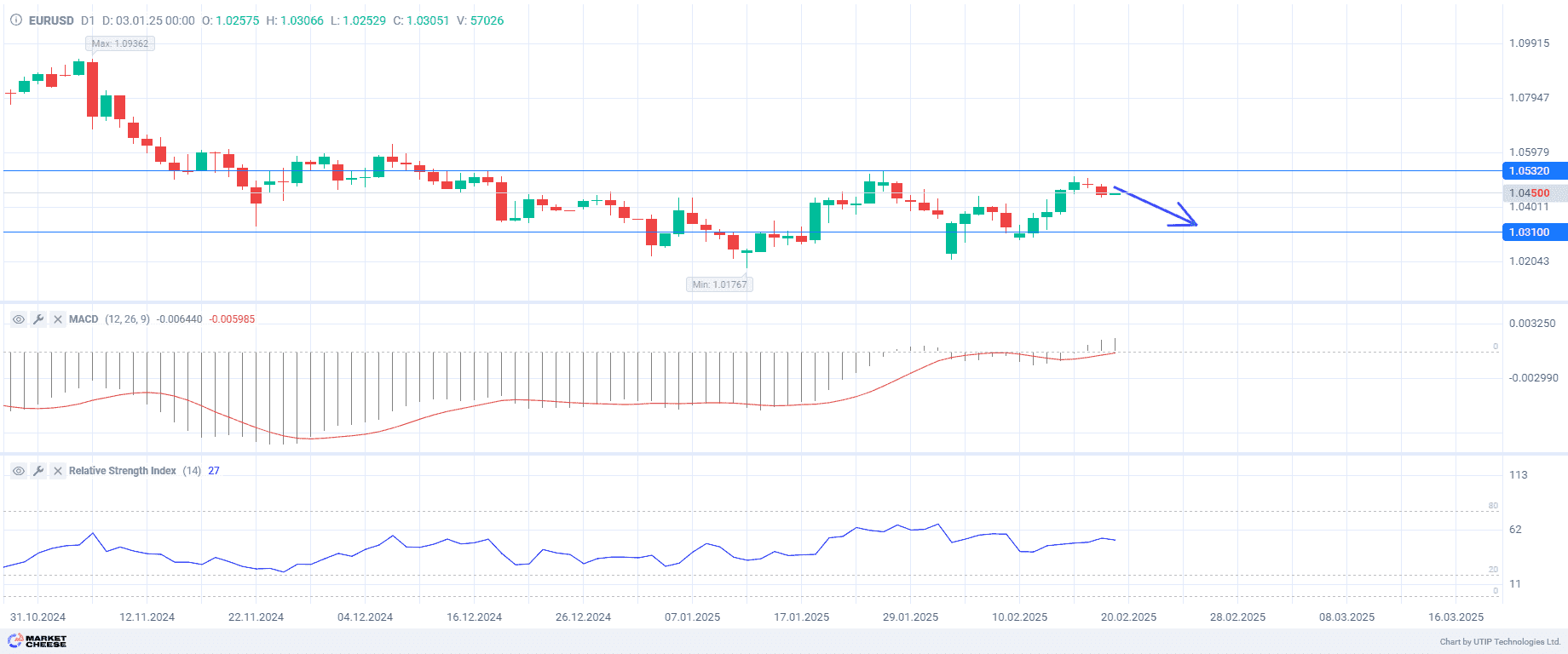

The technical analysis shows uncertainty in the market. The RSI is in the neutral area, not indicating a particular trend. The MACD indicator shows the presence of a bullish trend, but its weakening may lead to a correction or reversal in the near future.

Current recommendation:

Sell at the current price. Take profit – 1.03100. Stop loss – 1.05320.

Зарабатывайте с Grande Club

Торгуйте на различных финансовых инструментах и получайте выгоду за счет разницы в цене

Обеспечьте себе высокий доход при движении курсов валют

Начать инвестировать