19 February 2025

USDCAD consolidates before possible upward movement

The USDCAD currency pair is declining moderately on Wednesday. The dollar support was not strong enough, despite yesterday’s harsh rhetoric from the Federal Reserve (Fed) and the anticipated release of the FOMC minutes today.

As noted by the president of the San Francisco Fed Mary Daly, the outlook for rate cuts in 2025 remains uncertain. The president of the Philadelphia Fed Patrick Harker highlighted that the inflation remains high and requires maintaining the current policy.

Meanwhile, according to Statistics Canada, the consumer price index (CPI) rose 1.9% year-on-year in January against 1.8% in December. Such growth matched the analysts’ forecast. On a monthly basis, the index increased by 0.1% after decreasing by 0.4%. Bank of Canada core inflation, which excludes volatile categories (food and energy), moved up to 2.1% from 1.8%.

Against this background, traders lowered expectations of monetary policy easing by the Canadian regulator. The probability of the interest rate being unchanged during the March meeting rose to 63% versus 56% prior to the release of the statistics.

Traders are awaiting new statements of the Fed officials, since they may clarify the future course of the US monetary policy. Hawkish rhetoric can strengthen the dollar and support the currency pair growth.

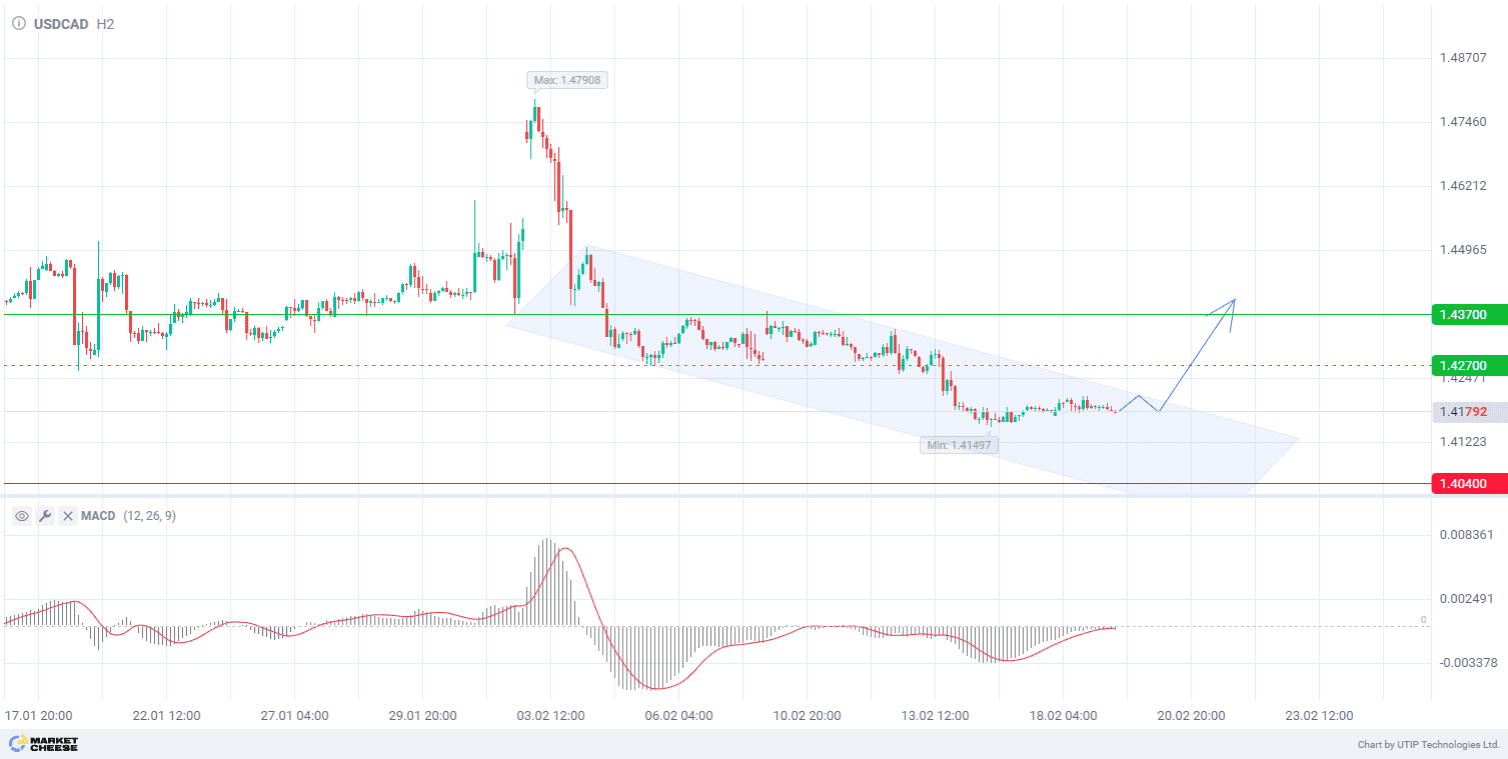

From the technical point of view, USDCAD quotes indicate market uncertainty, forming a descending corrective channel on the H2 timeframe. The MACD indicator (standard settings) is testing the zero line, which confirms the absence of a clear trend.

Since the latest correction is downward, volatility may increase when the range is broken and an upward momentum is formed. The fundamentals confirm this scenario to some extent.

Signal:

The short-term outlook for USDCAD suggests selling.

The target is at the level of 1.4370.

Part of the profit should be taken near the level of 1.4270.

A stop-loss could be placed at the level of 1.4040.

The bullish trend is short-term, so a trading volume should not exceed 2% of your balance.

Зарабатывайте с Grande Club

Торгуйте на различных финансовых инструментах и получайте выгоду за счет разницы в цене

Обеспечьте себе высокий доход при движении курсов валют

Начать инвестировать