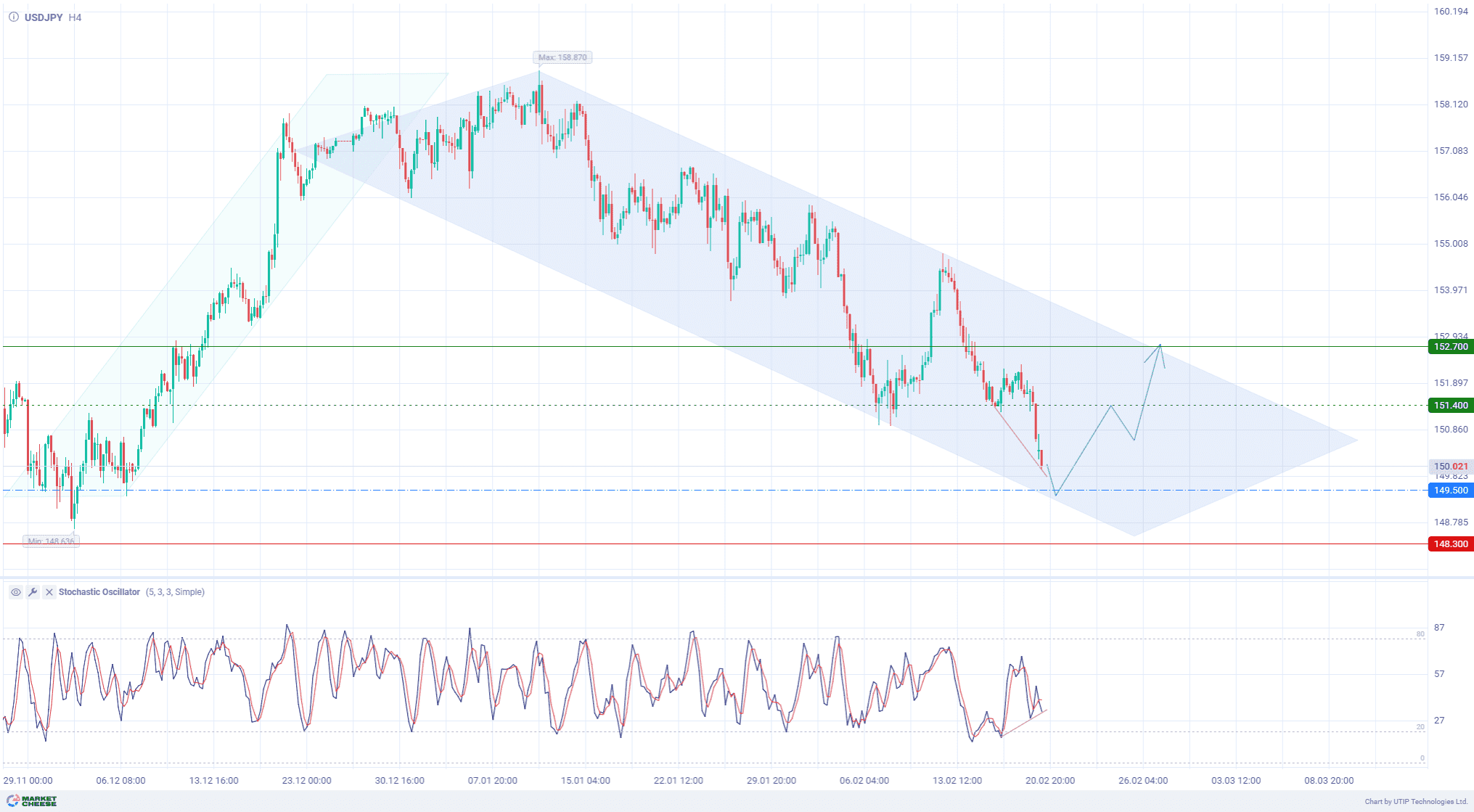

20 February 2025

USDJPY buyers expect rebound within channel to 152.70

USDJPY has been declining for two days in a row, approaching the psychological level of 150.00. The main growth driver for the yen is increasing expectations of interest rate hikes by the Bank of Japan due to persistent inflation.

Decreasing demand for risk assets additionally supports the yen. US President Donald Trump’s intent to impose new trade tariffs increases the concerns of global trade tensions.

A Reuters poll shows that over 65% of economists expect the Japanese regulator to tighten monetary conditions to 0.75% in the third quarter. Besides, wage growth is estimated to be 5.00%, exceeding January’s forecast of 4.75%.

US fundamentals have a mixed impact on the dollar. The Federal Reserve (Fed) meeting minutes showed the US regulator remains cautious about lowering interest rates for now. Fed officials highlight the high degree of uncertainty and the need to keep an eye on economic indicators.

On Thursday, the markets are awaiting the release of US jobless claims and the Philadelphia Fed Manufacturing Index. These indicators, as well as Fed officials’ speeches, may affect the further movement of the currency pair.

From the technical point of view, the USDJPY currency pair is in downward correction on the H4 timeframe. The latest momentum trend remains upward, and its range has not been broken yet. The current bearish movement may weaken after reaching the support level of the descending channel.

The Stochastic Oscillator (standard settings) divergence confirms the possibility of an upward reversal within the downtrend. Most traders have already taken into account the Bank of Japan’s monetary policy tightening and can adjust their positions in advance.

The best entry point for buying is near the channel support, around the level of 149.50.

Signal:

The short-term outlook for USDJPY suggests buying.

The target is at the level of 152.70.

Part of the profit should be taken near the level of 151.40.

A stop-loss could be placed at the level of 148.30.

The bullish trend is short-term, so a trading volume should not exceed 2% of your balance.

Зарабатывайте с Grande Club

Торгуйте на различных финансовых инструментах и получайте выгоду за счет разницы в цене

Обеспечьте себе высокий доход при движении курсов валют

Начать инвестировать