27 февраля 2025

Selling USDJPY amid diverging economic conditions in US and Japan

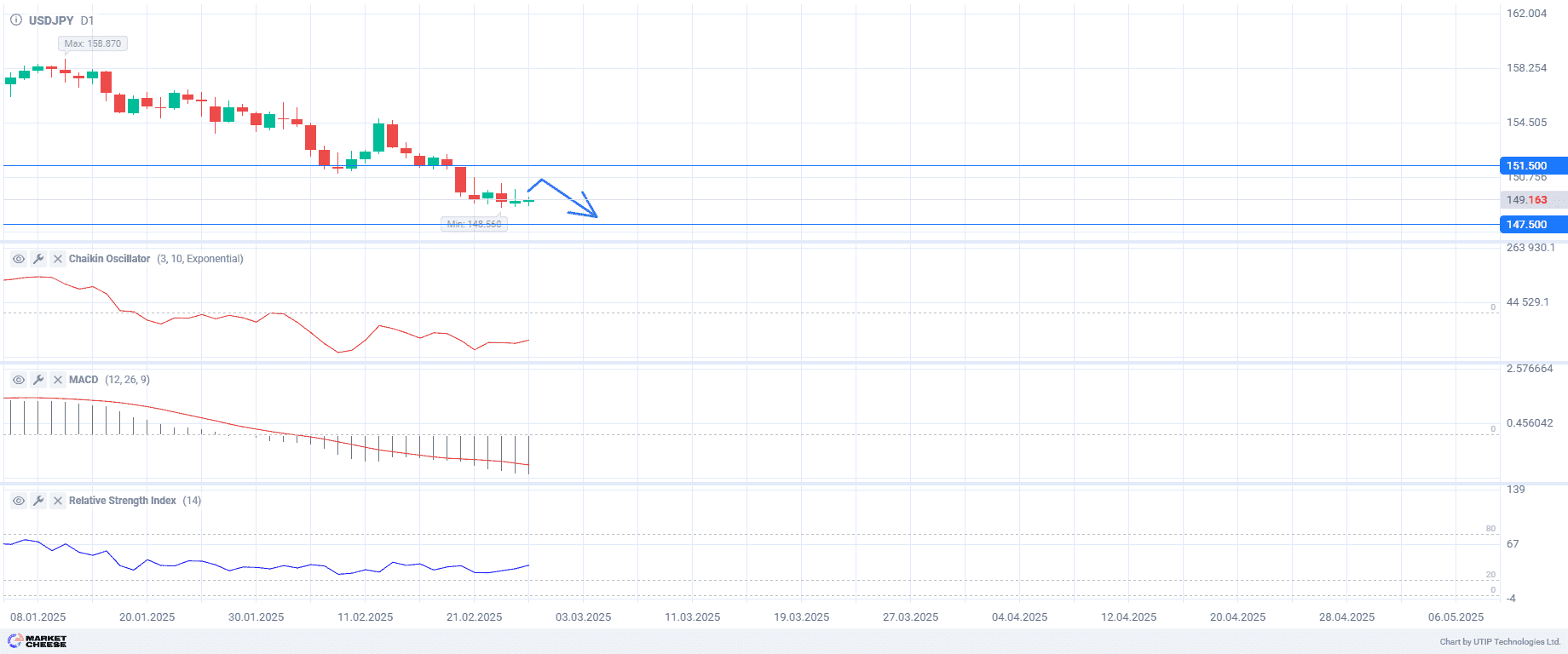

On Thursday, the USDJPY currency pair opened at 149.194, showing growth after a decline that began on February 10. Over this period, the rate fell by 6.9%, from 158.870 to 148.560. The decline was caused by a weaker US dollar amid concerns about the country’s economic situation and a stronger Japanese yen, driven by favorable data.

The US dollar is facing a challenge due to growing concerns about economic growth and inflation in the country. The situation is aggravated by the current president’ protectionist policies.

Markets are currently pricing in 57 basis points of rate cuts from the US Federal Reserve by the end of the year. The cut is expected to be at least 25 basis points, but the probability of such a move before the June meeting is below 50%. However, analysts note that lingering uncertainty about the impact of Trump’s tariffs could cause the Fed to proceed cautiously and slowly unwind potential rate cuts this year.

Meanwhile, the Bank of Japan (BOJ) continues to raise interest rates, propping up the yen. Japan’s top currency diplomat, Atsushi Mimura, said the currency’s strengthening was in line with positive economic data. In January, the BOJ ended its decade-long stimulus, raising the rate to 0.5%, due to confidence in achieving its 2% inflation target. BOJ Governor Kazuo Ueda emphasized the willingness to keep raising rates if sustainable progress is made. These factors increase the pressure on USDJPY.

The upcoming publications include the release of US GDP and unemployment rate data on February 27, as well as Japanese retail sales on February 28. According to forecasts, USDJPY may continue to decline.

Technical analysis indicates a possible increase in the exchange rate. On February 27, 2025, the Chaikin oscillator is in the negative zone, suggesting the prevalence of sellers. However, the indicator line has started to rise, which may signal a weakening of the downward trend. The increasing negative values of the MACD histogram so far indicate the persistence of the downtrend. Nevertheless, the RSI at 38 indicates that the asset is close to being oversold. This means that the price may start to rise, as sellers have already actively sold their positions, and buyers may begin to enter the market.

Current recommendation:

Sell at the current price. Take profit — 147.500. A Stop-loss — 151.500.

Зарабатывайте с Grande Club

Торгуйте на различных финансовых инструментах и получайте выгоду за счет разницы в цене

Обеспечьте себе высокий доход при движении курсов валют

Начать инвестировать