21 ноября 2024

Selling USDJPY with target at 152.00 influenced by BoJ policy

USDJPY is declining on Thursday after a speech delivered by Bank of Japan Governor Kazuo Ueda at an Europlace Financial Forum in Tokyo. According to Ueda, the central bank will seriously take into account changes in the exchange rate when forming the economic and inflation outlook.

Regarding monetary policy, the head of the regulator emphasized that decisions will be reached «meeting by meeting» on the basis of up-to-date information. A weak yen, which boosted import costs and inflation, was one of the factors that pushed the Bank of Japan to hike interest rates in July. Ueda also noted that the impact of the exchange rate is taken into account not only in economic calculations, but also in shaping inflation expectations.

Such remarks suggest the possibility of a new rate hike as early as next month. This signal, along with geopolitical risks, strengthened the yen’s position as a safe-haven asset, and also reinforced expectations of currency interventions.

With the US dollar correction, traders are awaiting more clarity on US President-elect Donald Trump’s policies. In addition, markets are trying to second-guess the prospects of less aggressive interest rate cuts from the Federal Reserve.

On Wednesday, two Fed governors voiced opposing views on US monetary policy. One of them expressed concern about persistent inflation, while the other remained optimistic, noting progress in reducing price pressures.

As a result, traders’ expectations for a rate cut at the December meeting have changed. According to the CME’s FedWatch tool, the odds of Fed’s monetary policy easing by 25 basis points fell to 56% down from the previous 85.7%.

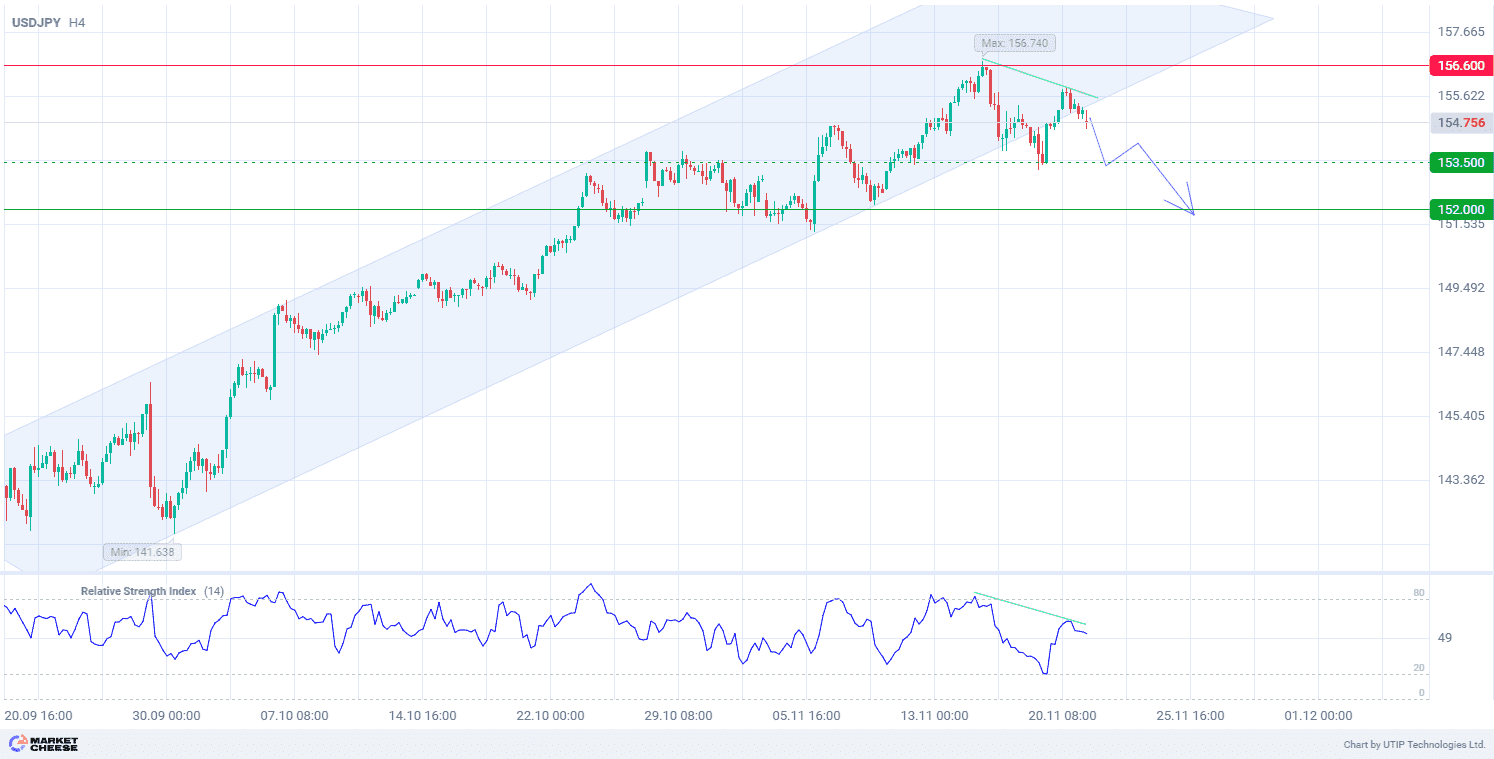

From the technical point of view, the USDJPY pair broke out of the uptrend on the H4 timeframe. The Relative Strength Index (RSI) convergence (standard parameters) signals a possible decline in the currency pair exchange rate or a transition to the correction phase.

Signal:

The short-term outlook for USDJPY suggests selling.

The target is at the level of 152.00.

Part of the profit should be taken near the level of 153.50.

A stop-loss could be placed at the level of 156.60.

The bearish trend is short-term, so a trading volume should not exceed 2% of your balance.

Зарабатывайте с Grande Club

Торгуйте на различных финансовых инструментах и получайте выгоду за счет разницы в цене

Обеспечьте себе высокий доход при движении курсов валют

Начать инвестировать